Imf Ukraine Debt Restructuring

debt restructuring ukraineKIEV March 24 Reuters - Ukraine is close to finishing talks for more loans from the International Monetary Fund but has no plans to restructure its debt to cope with the fallout from the. There have been significant developments in sovereign debt restructuring involving private-sector creditors since the IMFs last stocktaking in 2014.

A Debt Standstill For The Poorest Countries How Much Is At Stake

A Debt Standstill For The Poorest Countries How Much Is At Stake

A further 15 billion is.

Imf ukraine debt restructuring. Resident Representative for Ukraine Goesta Ljungman Resident Representative. Turning to the Aug. Online negotiations with the IMF mission which ran from late December to Feb.

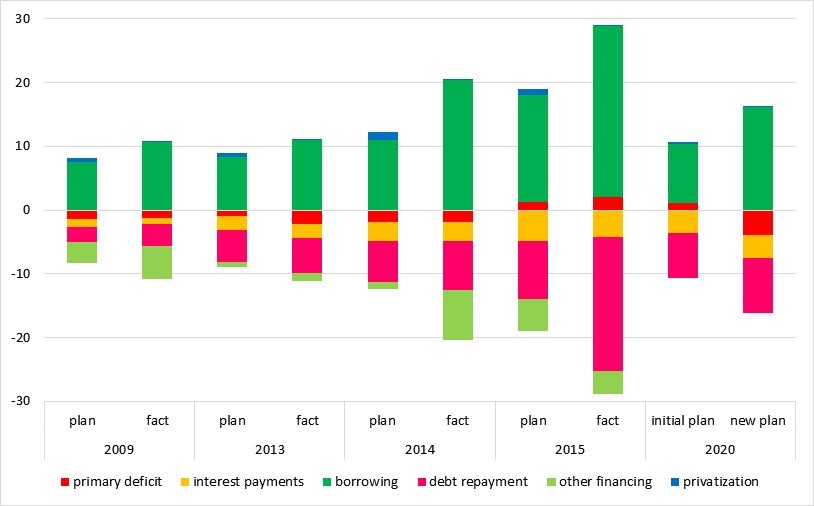

In Ukraine over the past four years the debt burden has been significantly reduced. And why can sovereign debt restructurings be difficult to achieve. Following a deep recession macroeconomic stabilization is taking hold.

This decrease is almost 2 times. KYIV Ukraine must make more progress on reforms to unlock the next part of a 5 billion loan the International Monetary Fund IMF representative in Kyiv said on Saturday after what he described as productive talks. An International Monetary Fund mission held productive talks with Ukraine but the country must show more progress on reforms to reach an agreement for a new tranche under the 5-billion program.

12 focused on strengthening. A sustained reform effort maintaining high primary surpluses and ambitious structural reforms will be needed to gradually reduce public debt from about 160 percent of GDP before the restructuring to the countrys 60 percent debt-to-GDP target. 1544 Views When is a sovereign debt restructuring needed.

Chad has requested that a common framework be set up between the Paris Club and. New IMF staff research looks at possible innovative sovereign debt instruments that could do both. Help creditors and debtors reach agreement on how to restructure debt by sharing some upside potential and make a countrys debt portfolio more resilient to future shocks.

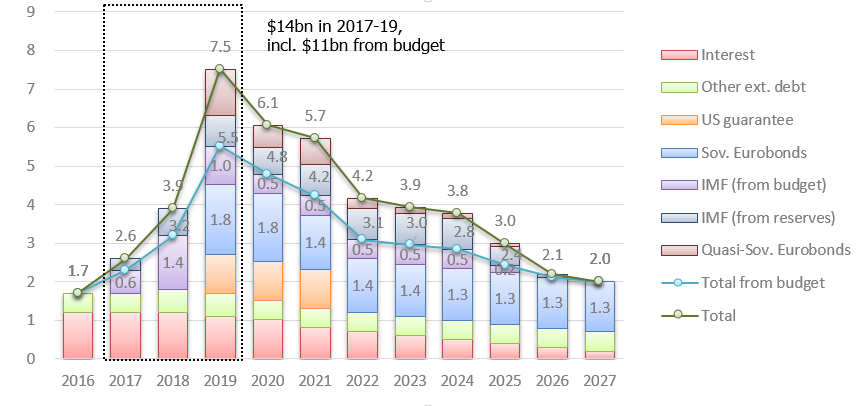

The Fund itself brings 175 billion over four years. 27 debt restructuring deal between Kiev and a group of its largest creditors Lagarde urged all Ukraines bondholders to support it. 13 2021 at 846 am.

It includes a write-down of 20 percent of. Discussions will continue Goesta Ljungman said in a statement. The framework enables debtor countries to seek an IMF programme to strengthen their economies and renegotiate their debts with public and private creditors.

While the current contractual approach has been largely effective in resolving sovereign debt cases since 2014 it has gaps that could pose challenges in future restructurings. Learn more about the main challenges and how the IMF can facilitate a solution. Discussions will continue Goesta Ljungman said in a statement.

Thus our debt is absolutely under control. Debt restructuring is the second largest source of outside financing for Ukraines new International Monetary Fund IMF program. 13 2021 By Reuters Wire Service Content Feb.

UKRAINE 4 INTERNATIONAL MONETARY FUND INTRODUCTION 1. Already one of the beneficiaries of the Debt Service Suspension Initiative DSSI Chad has just officially requested debt restructuring from its major public creditors as well as a support agreement with the IMF. IMF Wants More Reforms for Ukraine to Get Next Part of Loan By Reuters Wire Service Content Feb.

Ukraine must make more progress on reforms to unlock the next part of a 5 billion loan the International Monetary Fund IMF representative in Kyiv said on Saturday after what he described as productive talks. The IMF yesterday approved a four-year 175 billion arrangement for Ukraine their contribution to a 40 billion financing gap that they have identified over that period. While the crisis inflicted a significant cost on Ukrainecompressing incomes straining the financial system and setting public debt on an unsustainable paththe worst of the economic storm seems to be over.

Ethiopias plan to seek debt restructuring under a G20 common framework agreed in November triggered a sell-off in African debt at the end of January on fears of a contagion effect. What do we have in Ukraine. Exclusive interview with Ukraines parleamentary speaker - Ukraine should think of IMF debt restructuring from the perspective of can we do this - Parliamentary Speaker - 112international Exclusive interview with Ukraines parleamentary speaker Dmytro Razumkov on Covid-19 Ukraine-IMF cooperation MPs salaries and local elections.

96 billion comes from governments and other multilaterals including Europe the United States and most recently China leaving 153 billion for the debt operation. KIEV Reuters - Ukraines Finance Ministry announced on Thursday it had completed a debt restructuring of around 15 billion with creditors and said it remained open to finding a debt solution on. Zambian Finance Minister Bwalya Ngandu expects to secure an International Monetary Fund loan that could underpin debt-restructuring talks with external creditors before the nation holds.

For absolutely objective reasons. If we started 2017 with a debt of 80 of GDP then in 2020 we entered with a debt burden of 50 of GDP.

Ukraine Secures Debt Relief Deal Finance Ministry Says Wsj

Ukraine Secures Debt Relief Deal Finance Ministry Says Wsj

Chapter 19 Restructuring Sovereign Debt Lessons From Recent History Financial Crises Causes Consequences And Policy Responses

Chapter 19 Restructuring Sovereign Debt Lessons From Recent History Financial Crises Causes Consequences And Policy Responses

Why The Coming Emerging Markets Debt Crisis Will Be Messy Financial Times

Why The Coming Emerging Markets Debt Crisis Will Be Messy Financial Times

Ukraine S Budget Deficit And Government Debt

Ukraine S Budget Deficit And Government Debt

The Big Discussion At Voxukraine Or A Dozen Knives In The Back Of The Imf

The Big Discussion At Voxukraine Or A Dozen Knives In The Back Of The Imf

Restructuring Sovereign Debt Busted Flush Finance Economics The Economist

Restructuring Sovereign Debt Busted Flush Finance Economics The Economist

Here S Why The Imf Insists On Debt Restructuring For Greece Atlantic Council

Ukraine Request For Extended Arrangement Under The Extended Fund Facility And Cancellation Of Stand By Arrangement Ukraine Request For Extended Arrangement Under The Extended Fund Facility And Cancellation Of Stand By Arrangement

Ukraine Request For Extended Arrangement Under The Extended Fund Facility And Cancellation Of Stand By Arrangement Ukraine Request For Extended Arrangement Under The Extended Fund Facility And Cancellation Of Stand By Arrangement

Ukraine Ukraine First Review Under The Stand By Arrangement Requests For Waivers Of Nonobservance And Applicability Of Performance Criteria And A Request For Rephasing Of The Arrangement

Ukraine Ukraine First Review Under The Stand By Arrangement Requests For Waivers Of Nonobservance And Applicability Of Performance Criteria And A Request For Rephasing Of The Arrangement

Chapter 9 Experiences With Sovereign Debt Restructuring Case Studies From The Oecs Eccu And Beyond The Eastern Caribbean Economic And Currency Union Macroeconomics And Financial Systems

Chapter 9 Experiences With Sovereign Debt Restructuring Case Studies From The Oecs Eccu And Beyond The Eastern Caribbean Economic And Currency Union Macroeconomics And Financial Systems

Chapter 8 Debt Restructuring In The Caribbean The Recent Experience Unleashing Growth And Strengthening Resilience In The Caribbean

Chapter 8 Debt Restructuring In The Caribbean The Recent Experience Unleashing Growth And Strengthening Resilience In The Caribbean

Https Www Imf Org Media Files News Seminars 2018 091318sovdebt Conference Chapter 9 Challenges Ahead Ashx

Commercial Bank Debt Restructuring The Experience Of Bulgaria International Economic Policy Review Volume 1

Commercial Bank Debt Restructuring The Experience Of Bulgaria International Economic Policy Review Volume 1

Ukraine And Belarus Seek Loans To Ride Out Covid 19 Emerald Insight

Ukraine And Belarus Seek Loans To Ride Out Covid 19 Emerald Insight